How to Build a FinTech App: A Step-by-Step Guide

A new generation of financial technology called Fintech apps is here. FinTech apps are reshaping the landscape of finance at a time when money and technology are not separable concepts anymore. As time continues to flow, the traditional methods become replaced by digital inventions whereby fintech goes further up, providing extraordinary comfort and convenience to the involved persons.

The projected total value of the world´s fintech market is said to be $165.4 billion in 2023?. Hence, the global fintech market is estimated to touch on $324 billion with the CAGR of 25.18% till 2026.

This article takes you into the world of FinTech app development, which has revolutionized the finance industry as a whole. Here’s a quick preview of what lies ahead:

- Building the FinTech Future: Process of developing FinTech apps.

- Decoding FinTech Software Development: Reveal the complexities and nuances of FinTech software.

- Unveiling the FinTech App: Why a FinTech app is a game changer.

- Timelines and Realities: Determine how long it will take to develop a FinTech app.

- AI's FinTech Influence: How Artificial Intelligence meets with Fintech?

- Strategies for FinTech Growth: Find ways of popularizing and expanding your FinTech app.

- Cost Realities: Get an idea of what goes into building a FinTech solution.

- Navigating Challenges: Factors that inhibit Fintech app development knowledge.

- Payment App Costs: Discuss in detail on the costing of developing a payment focused application. human written

Let us take you through the process of understanding the ‘how’, ‘what’ and ‘why’ behind Fintech app development and its transformation role in reorganization of the industry. Let's dive in!

How to Build FinTech Apps?

Building a successful FinTech platform involves a combination of innovation, technology, and deep expertise in financial systems. Therefore, let us break down those development phases into smaller pieces in order for you to easily apply your own fintech idea into a ready working application.

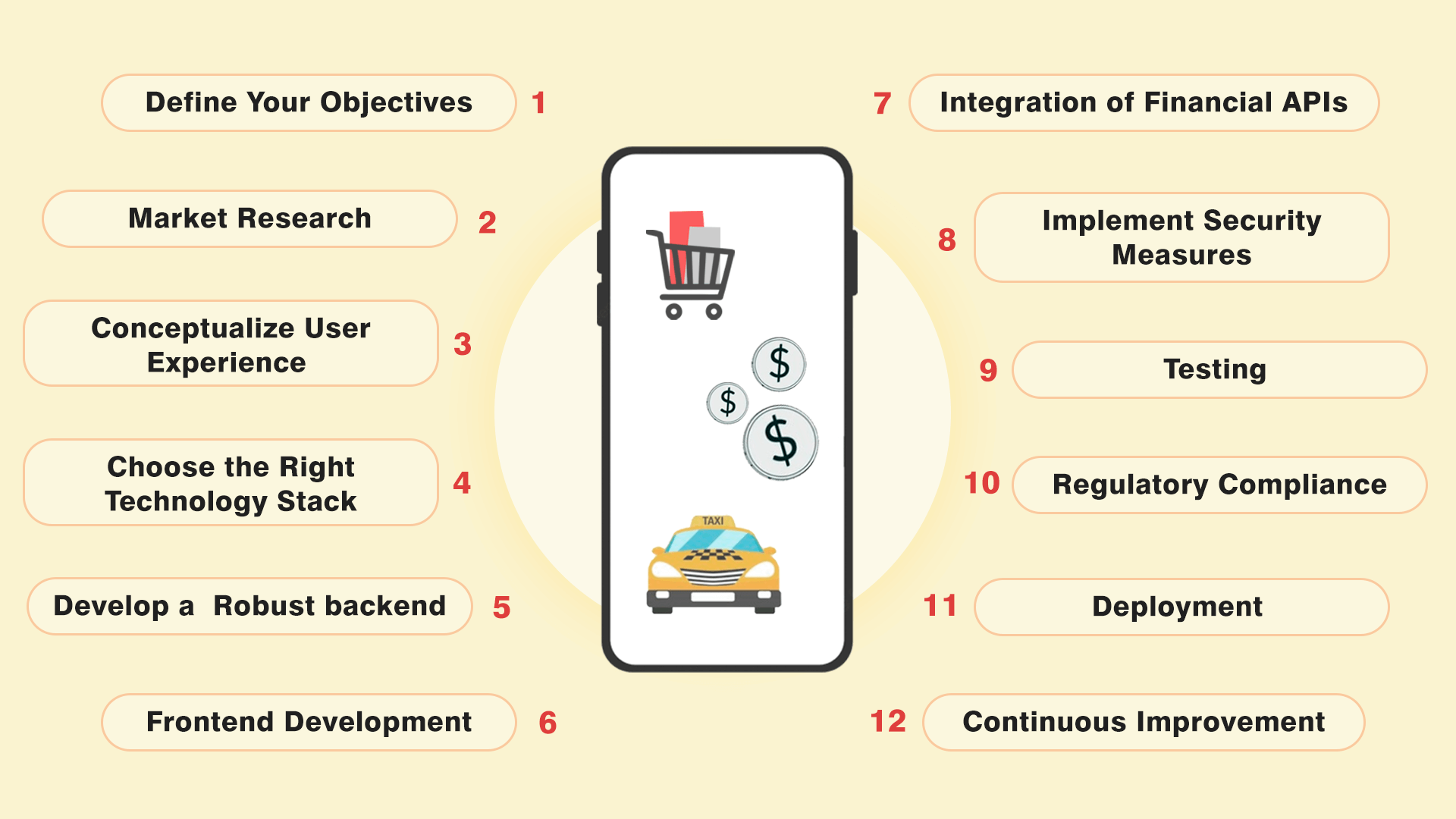

Define Your Objectives

Specify the mission statement for your FinTech app. Does it concentrate on payments, investment, or any other financial product/service? The whole development process is built around understanding your objectives.

Market Research

Dive into comprehensive market research. Know what hurts your potential customers and their aspirations. You must analyze competitors and find out what niches there are in the market where your FinTech app could fit perfectly.

Conceptualize User Experience (UX)

Come up with an uncomplicated and friendly user interface. Develop sitemaps, flows, wireframes, and prototypes. Focus on intuitive user interfaces enabling straightforward financial operations.

Choose the Right Technology Stack

One of which, choosing a technology stack is crucial. In this regard, you should take into account scalability, safety, and interoperability concerning technological solutions like programming languages, frameworks and databases that meet your application’s needs.

Develop a Robust Backend

Construct an ironclad and reliable internal system. Include essential elements such as user authentication, data storage, and linking with financial API.

Frontend Development

Build an elegant and functional frontend. Provide a consistent user experience across multiple devices . Incorporate features that increase interactivity of the users.

Integration of Financial APIs

Connect your FinTech app with appropriate financial APIs. It helps to integrate it with bank systems, payment gateways and other financial organizations.

Implement Security Measures

Protect the security for customers’ information and transactions. Encrypting data, adopting rigid authentication procedures, as well as carrying out regular auditing and patch management programs will ensure that your company is safe from all possible threats.

Testing

Ensure you have sufficiently tested your FinTech app. Conduct functional testing, security tests, and usability tests to locate and fix bugs prior to the app’s launch.

Regulatory Compliance

Complying with financial regulations and data protection rules. Partner with legal specialists in order to maneuver through compliance issues and avert legal traps.

Deployment

Roll out your FinTech app into the chosen one or many platforms. Pay close attention to it at this stage to be prepared for unforeseen difficulties and handle them quickly.

Continuous Improvement

This is a sector that is continually shifting. Collect user’s views, keep track of the app’s progress and remain informed on the latest market trends.

Building a Fintech application is an extremely dynamic procedure that necessitates a strategic approach as well as constant agility. You have taken the right step by following these essential steps which serve as a base on which users get smooth and secured financial experience.

Understanding FinTech Software Development

Here you are welcome inside the core of the FinTech revolution which is driven by modern software development that redesigns finances for a better future. Demystifying FinTech software development and discovering the technology behind the innovation in this dynamic environment.

Defining FinTech Software Development

The key element of FinTech software development is developing digital products that turn a new page in the history of finance. It entails developing apps, platforms as well as finance systems that utilize advanced technology in simplifying and improving different functions within finance.

In simple terms, FinTech software development refers to leveraging code power to bring about revolutionary changes in how we do finance.

Technologies Commonly Used in FinTech App Development

1. Blockchain Technology

- Many FinTech applications exist which are based on

- as a technology that offers decentralization and secure transactions for financial operations. The technology is behind cryptocurrency and it extends further in terms of the transparent and tamper-free financial transactions.

2. Artificial Intelligence (AI) and Machine Learning (ML)

- Using I as well as ML algorithms to mine through massive financial datasets. They also enhance intelligence in FinTech apps that are used for chatting for customer services, fraud detection, as well as recommending personalized finances.

3. Cloud Computing

- Flexibility and scalability of cloud platforms are required by FinTech applications to perform varied loads. They increase availability, facilitate ease of memory storage, and provide robustness within each organization.

4. APIs (Application Programming Interfaces)

- Therefore, APIs serve as the communication link between various software devices. Integration with banking systems, payment gateway, among others is facilitated in FinTech using APIs. They promote rapid and accurate transmission of data in real time.

5. Cybersecurity Solutions

- Strong cyber security is an absolute must because of confidentiality and reliability demands around the financial information. Protection of user information and financial transactions requires encryption, secure authentication, and continuous monitoring.

6. Mobile Development Frameworks

- Fintech is mostly dominated by mobile apps. Development tools like React Native and Flutter help in faster development of cross platform applications to provide a uniform user interface on every device.

The fusion of these technologies brings out the picture of a complex environment behind the FinTech systems development. An innovative yet safe amalgamation of every piece of code that seeks rewriting the definition of tomorrow’s financing industry. Join us in this voyage of FinTech as we explore the workings of these tech behind the ease in using FinTech Apps.

What is a FinTech App?

The realm of FinTech apps – welcome to the world, where finance and tech meet! We are going to discuss the nature of these applications. What exactly do they constitute, why are they irreplaceable in today’s finances?

A FinTech app refers to a customized digital tool that aims at restructuring and streamlining how we use our finances. These apps use technological force to put money directly on our palms thereby saving time.

The varieties of solutions within fintech apps span from busy urban centers in payment apps and complex worlds of investments. These systems help to fill in the gap between conventional financial services and the digital age by offering customized experience for users based on their specific financial requirements.

Common Features and Functionalities

1. Mobile Banking

- Convenient access to banking services on your finger tips. In addition, most FinTech apps usually come with services that include checking balances, remittances, payments, convenient banking, among others.

2. Digital Wallets

- Digital wallet is revolutionizing how it is done as people can now add the card details in their phones and pay just by tapping their phones.

3. Investment Platforms

- The investment apps of FinTech empower users to be able to buy or sell stocks, track their portfolios, and even access real time market information.

4. Peer-to-Peer (P2P) Lending

- P2P platforms revolutionize lending by cutting off traditional financial intermediaries and directly connecting borrowers and lenders.

5. Cryptocurrency Exchanges

- This has led to the emergence of FinTech apps in the era of decentralized finance, through which users can perform transactions such as buying, selling, or trading of cryptocurrencies.

6 Budgeting and Expense Tracking

- These features aim to make users have control over their finances and it includes revealing the spending patterns, setting budget goals, and giving finance advice.

7. Insurance Comparison and Management

- The financial technology or commonly abbreviated as FinTech app simplifies users’ insurance process whereby they can compare insurance plans, manage their policies and also submit their claims all at the same time online.

8. Robo-Advisors

- Robo-advisors automate investment strategies whereby they apply algorithms to provide customized investment advice depending on users’ preferences and risk tolerance.

From this point onward, FinTech apps seem less like devices and more like a means for financial liberation. Let’s get started to explore the intricacies of these platforms to learn more about how they shape our bank accounts.

Development Timeline: Navigating the FinTech App Creation Journey

Ah! The million dollar question - how long will it take to take a FinTech app from an idea to reality? Hold tight in your seat and fasten your seatbelt as I trace the complex paths of development time in this compelling voyage, detailing the elements that influence it.

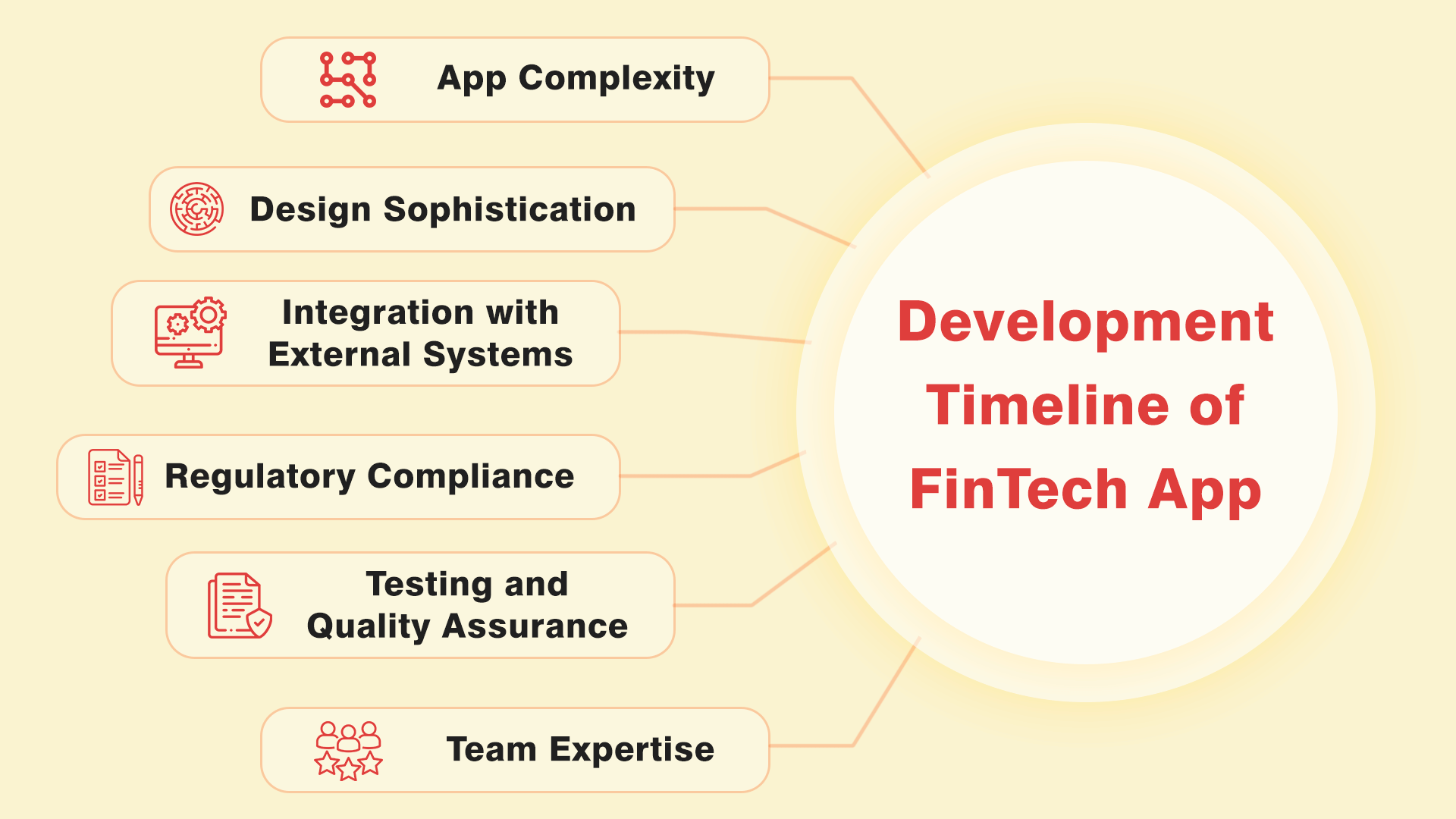

Factors Influencing Development Timelines

Before we dive into the timeline specifics, let's understand the variables that influence the development pace of a FinTech app:

App Complexity

How much effort does it take to develop your app? Depending on the number of functions that are incorporated into it, app development can be extremely complex. It could be faster for a simple payment app or slower for a comprehensive investment platform utilizing complex algorithms.

Design Sophistication

It is not easy to create a user-friendly and visually appealing design. The overall development duration also depends on the sophistication of the user interface and experience design.

Integration with External Systems

Time during the development cycle is also likely to be affected due to complexities associated with integration with other third party systems such as bank API or payment gateway.

Regulatory Compliance

Complexity in addition to financial regulation. But doing so would probably stretch out the app’s development time and ensure that it complies with industrial standards and regulations.

Testing and Quality Assurance

Rigorous testing is crucial for the success of any FinTech as such processes ensure secure and properly-functioning transactions. It takes a long period of development which enables careful testing.

Team Expertise

Considering the experience of your development team is an important thing. A good/competent and experienced team would well comprehend the hurdles they are encountering and possibly mitigating the development time.

Now, let's break down the development timeline into key milestones:

Development Milestones.

| Milestone | Estimated Time |

|---|---|

| 1. Project Planning | 2-4 weeks |

| 2. Design and Prototyping | 4-6 weeks |

| 3. Backend Development | 8-12 weeks (depending on complexity) |

| 4. Frontend Development | 6-10 weeks (depending on design complexity) |

| 5. Integration | 4-8 weeks (integrating with external systems) |

| 6. Testing and QA | 6-10 weeks |

| 7. Regulatory Compliance | 4-8 weeks (if applicable) |

| 8. Deployment | 2-4 weeks |

| 9. Post-launch Optimization | Ongoing |

The road map for Fin-tech app development is a thrilling endeavor that entails grasping the details of the time frame as it gives rational anticipation. With our map in place, you’ll have to wait and see as we navigate into the exciting realm of building FinTech apps. It will be a more exciting journey ahead.

Role of AI in FinTech: Unleashing the Power of Innovation

The crossroad between financial technology and artificial intelligence is what you call welcome to the frontier. This is where we begin our exploration to unfold that, although AI is only a technology part, it is a transformational one that can alter FinTech scenarios.

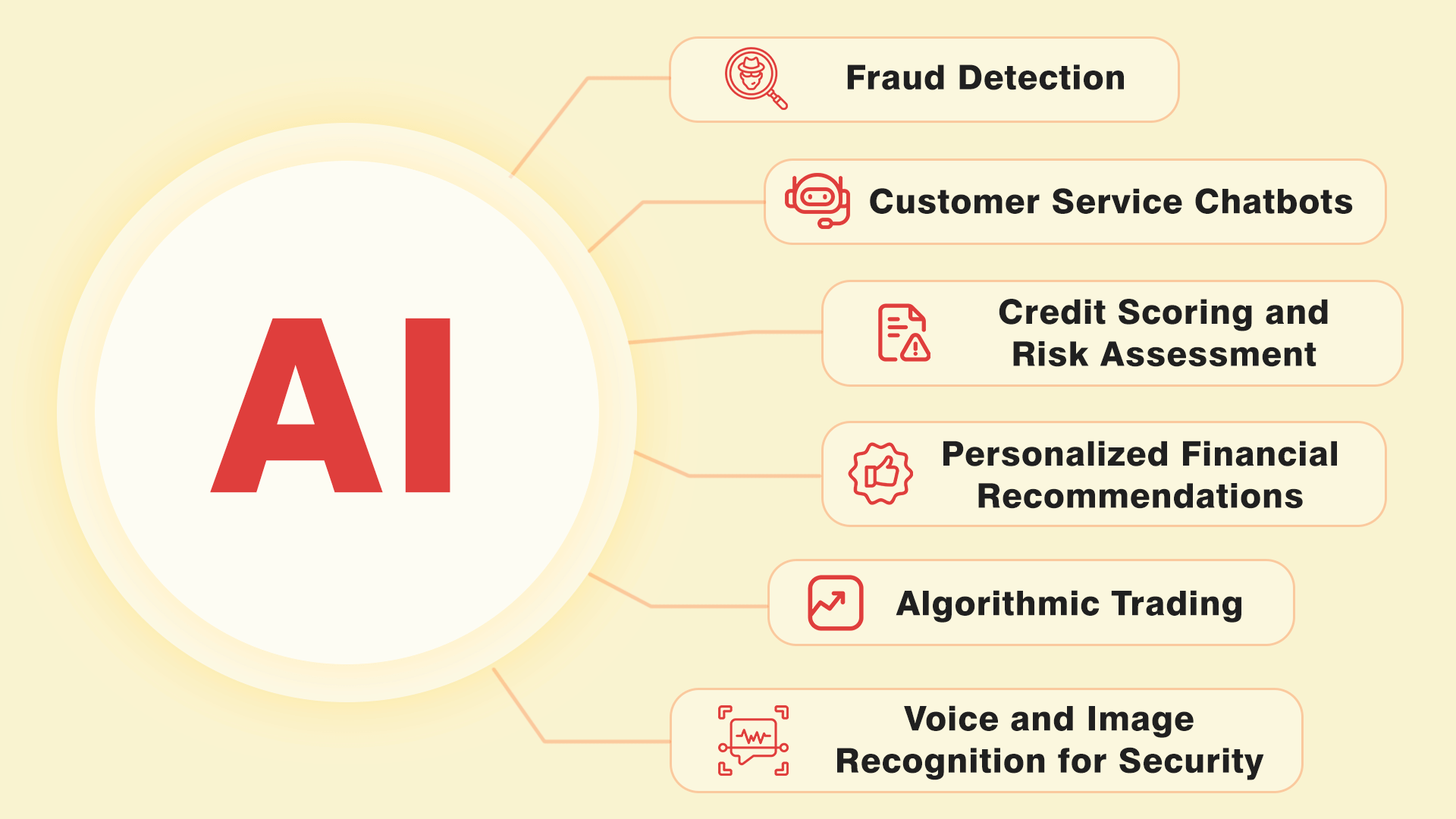

How FinTech Harnesses Artificial Intelligence

Artificial intelligence acts as an agent of transformation in FinTech displacing conventional aspects of financial procedures. Here's a glimpse into how FinTech taps into the power of AI:

- Fraud Detection

These days AI algorithms process immense databases to find out unusual transaction patterns or any outliers. This takes a proactive attitude that aims at increasing security by rapidly detecting and minimizing possibly fraudulent activities.

- Customer Service Chatbots

Virtual assistants that utilize artificial intelligence answer customer’s questions on the spot thus giving customizable assistance. These chatbots improve user experience with fast troubleshoots and 24/7 support.

- Credit Scoring and Risk Assessment

Credit scoring models powered by AI look at factors like customer’s activity as well as purchase patterns. Such allows for better risk assessments, including users with irregular/no traditional credit history.

- Personalized Financial Recommendations

With these insights, AI algorithms are able to understand user spending habits and overall financial behavior, leading to more tailored suggestions. Using Artificial Intelligence in Fintech apps whether it's an investment strategy or a budgeting tip, for personal needs of specific users.

- Algorithmic Trading

Artificial intelligence algorithms control trading in the modern market environment that uses information collected from current trends. The use of this automated approach improves the pace as well as the quality of decision-making during the trade process.

- Voice and Image Recognition for Security

Using the most sophisticated biometric authentication, FinTech apps incorporate voice and image recognition into their security measures for user access.

Benefits of AI in FinTech

- Enhanced Efficiency

AI automation enables efficient completion of common duties in the financial operations hence lowering human effort.

- Improved Customer Experiences

It results in superior customer experience that helps in building a loyal and retentive user base through personalized interactions, faster query resolution, specific financial recommendations among others.

- Risk Mitigation

Using AI-based risk assessment models in determining the credibility of an individual or business reduces chances of default as well as fraud, thereby curbing financial risks.

- Real-time Decision Making

Real-time analysis of data is made easy with AI allowing quick decision making in sectors like stock trading which is very important.

- Innovation and Adaptability

This enables FinTech organizations to stay ahead with innovation as well. Adapteness of AI systems makes sure Finance applications and Fintechs are moving together hand in hand with new technology emergence.

In essence, as we walk through the complicated maze of FinTech and AI collaboration, this collaboration is not just about efficiency but reshaping financial services. Watch out for further developments in AI as more and more algorithms are unleashed towards building a better future for FinTech.

Strategies for Growing a FinTech App: Navigating the Path to Success

The adventure does not finish when you have developed your FinTech app; it's only a start. Let us find out how to push your app up from an electronic precious stone into the living system including marketing strategy and establishing relationships between you and your customers.

Strategic Marketing

Define Your Unique Value Proposition (UVP)

- The uniqueness of your FinTech app must be clearly stated. Ensure that the UVP appeals to your main customers on matters of either breakthrough feature, security, or user-friendly design.

Content Marketing

- Be a contributor by writing blogs, articles, and educational materials. Structure your FinTech app as an industry expert, delivering insights that attract and engage your audience.

Social Media Engagement

- Engage and relate through social media platforms to reach out to your audience. Keep up with updates, customer testimonials, and have conversations that foster a feel of a community around your FinTech brand.

Influencer Partnerships

- Work with fintech and financial influencers. The benefit of such support lies in an increased visibility and trust in the application in their followers.

User Acquisition

Referral Programs

- Launch reward-based referrals that encourage your current user base to bring in their friends and families. In addition, word-of-mouth still remains an effective method of user acquisitions.

Partnerships and Collaborations

- Form strategic alliances with other companies or financial entities. Shared Audience: New user paths through collaborative approaches.

Targeted Advertising

- Consider investing in focused digital ads that target specific audiences. You can also make use of platforms such as Google Ads and others that will help you to narrow down on your target audience.

Optimized App Store Presence

- Optimize your app’s visibility on app stores. Make use of strategic keywords, striking imagery, and concise product descriptions so as to draw prospective customers.

Customer Retention

User Onboarding

- Provide a seamless onboarding experience. Walk users through a few important aspects of your FinTech app, and educate them as to why it’s valuable right away.

Regular Communication

- Ensure users are notified of recent changes, new functions, and improvements in assurance. Ongoing communication fosters engagement and guarantees that users are aware of the importance you give to their experience on the website or via a mobile channel.

Personalization

- Customize user experience according to their actions and choices. Personalized recommendations, messages, and alerts promote personal feelings of attention.

Customer Support

- Offer responsive customer support channels. Reliable support systems include chats, emails, phones and so forth and create confidence in the firm and loyalty among clients.

Exclusive Benefits

- Offer loyal customers something that no one else can get, like the best of the bunch when it comes to perks that include extra services, promotions and the like. Help long-time users feel like part of a community.

Growth path for FinTech apps is both an art and science. Through a strategic marketing approach, effective user acquisition, and unwavering concentration on your customers’ retention, you set yourself for long-term success. You will also shape the future of financial technology as your FinTech app continues making more impacts. Watch out for more knowledge about this enchanted adventure.

Cost of FinTech Software: Unveiling the Investment Landscape

However, one has to understand how much will be invested for embarking on the journey of fintech application development. Now, let’s see what affects costs in general and analyze certain facts associated with the budget for your FinTech business idea.

Factors Affecting the Cost of FinTech Software

Complexity of Features

- For more complicated features, it comes at a higher development cost. As for complete Fintech apps, this type will usually be more expensive due to its features like investment algorithms or blockchain integration.

User Interface and Experience Design

- A smooth and appealing user interface leads to good user experiences, which is one of the ways of investing. Nevertheless, complex design components could influence development costs.

Integration with External Systems

- Additional problems in terms of costs come from integration into an external system – for instance, banking API or a payment portal.

Security Measures

- This is because financial information is critical. Encryption, secure authentication, and following certain industry standards can cost more during development.

Regulatory Compliance

- Compliance with financial regulation imposes an extra burden and expense. It is important for a FinTech application to be compliant with the relevant statutes and industry standards.

Country-Specific Statistics

United States

- Average hourly rates: $150 - $250

- Overall development cost range: $150,000 - $500,000+ for a comprehensive FinTech app.

United Kingdom

- Average hourly rates: £100 - £200

- Overall development cost range: £100,000 - £400,000+ for a comprehensive FinTech app.

India

- Average hourly rates: $25 - $50

- Overall development cost range: $25,000 - $150,000+ for a comprehensive FinTech app.

Ukraine

- Average hourly rates: $30 - $50

- Overall development cost range: $30,000 - $150,000+ for a comprehensive FinTech app.

Armenia

- Average hourly rates: $20 - $40

- Overall development cost range: $20,000 - $120,000+ for a comprehensive FinTech app.

Australia

- Average hourly rates: $100 - $150

- Overall development cost range: $100,000 - $300,000+ for a comprehensive FinTech app.

The hourly rates and total development costs on this basis vary per region within these countries. These figures ought to be part of your strategic planning towards the right mix of costs and expertise in every venue. Understanding these considerations when starting out is vital for budgeting and developing your good Fintech app.

Challenges in FinTech App Development: Navigating the Complexities

The process of developing a FinTech app is thrilling but comes with some problems. Let’s explore the details, potential issues, and provide appropriate measures to confront them.

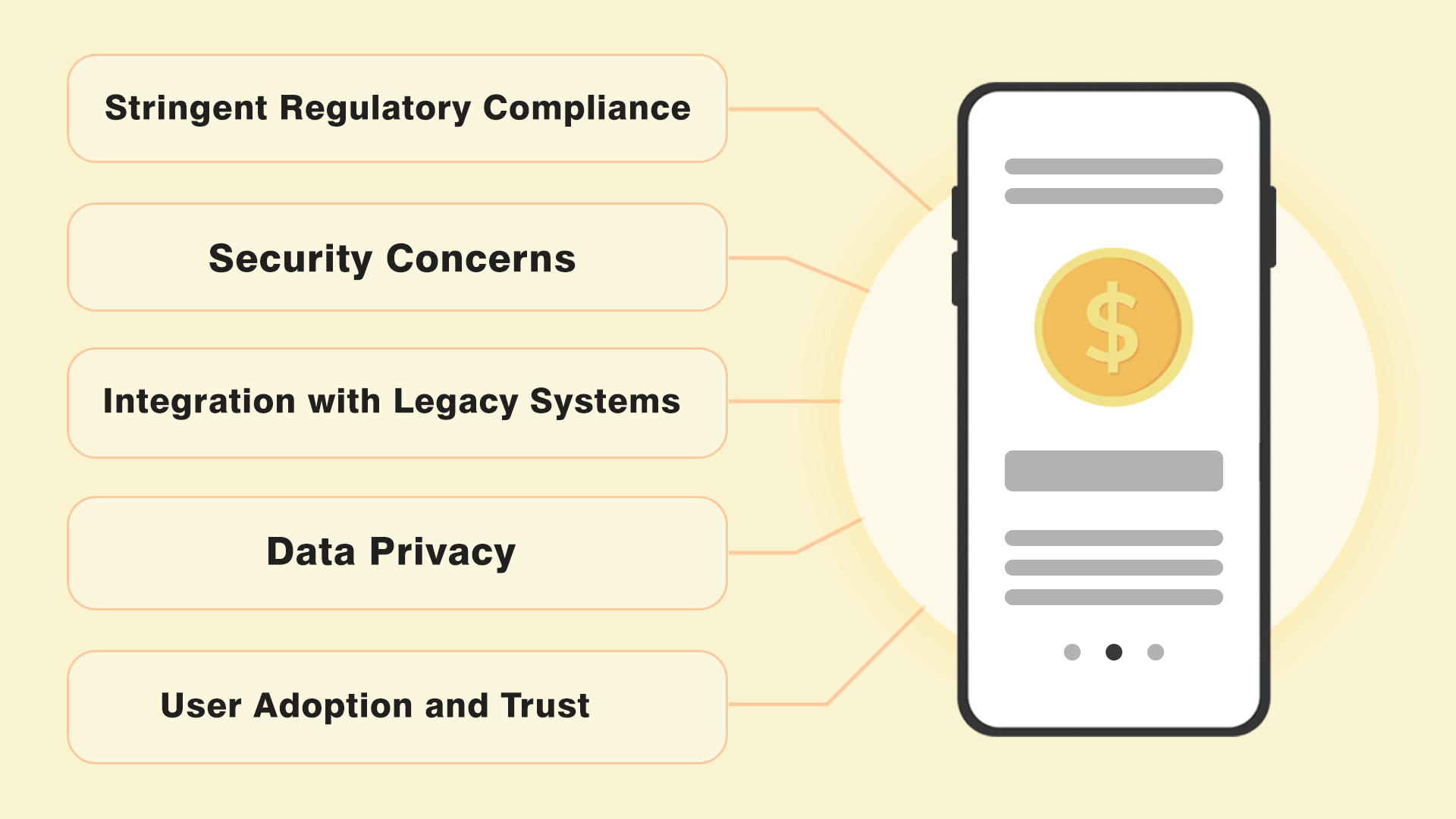

Common Challenges

Stringent Regulatory Compliance

- Challenge: Complying with the changing financial rules and regulations is often very tricky as it involves a lot of accuracy in detail.

- Solution: Partner at will with a lawyer who knows the changes in regulation and stay on track throughout the process. Conduct regular audits of your app’s compliance to confirm that it matches the current legal and industry requirements.

Security Concerns

- Challenge: The security issue posed by confidentiality of financial information is ever present.

- Solution: Use up to date encryptions, multi factor authentication, and perform ongoing security audits. Always be updated on current security systems and trends.

Integration with Legacy Systems

- Challenge: However, the process of integrating the Fintech app with legacy systems in financial institutions is often not straightforward because of different technologies and standards.

- Solution: Use properly documented APIs work, closely cooperate with organizations and think of phased integration in order not to disrupt.

Data Privacy

- Challenge: Safeguarding user data is paramount. However, it is a challenge to guarantee that data privacy would be tightly adhered to and users trusted.

- Solution: Enact strong data encryption, observe relevant data protection regulations, and be open with clients about how you handle private information.

User Adoption and Trust

- Challenge: However, it can be quite hard to gain user’s trust in fintech as well as convince them to take up any new fintech app.

- Solution: Make an effort to educate users, make clear communications on the usefulness of the app and its security aspects and deliver top class customer service.

Tips for Overcoming Challenges

Collaborate with Industry Experts

- Create alliances with expert FinTech, law practitioners, auditors, etc. They have insights that can help one traverse through regulatory spaces.

Continuous Learning

- Keep yourself informed on the modern technologies, security measures, and updates in regulation laws. A good FinTech needs continuous learning in ensuring it stays relevant in the innovations.

User-Centric Design

- Make the app more appealing and easier for users by concentrating on user-oriented design. User testing with iterations for getting feedback.

Agile Development Practices

- Use agile development processes to become flexible. Keep reviewing your development strategy from time to time following changing challenges and opportunities.

Transparent Communication

- Create open lines of communication with the users. Ensure you update them on anything relating to upgrades, security measures, and general changes.

Financial technology apps are more challenging than the usual application because you can’t overcome the problem, you should create a solid application from the onset that will withstand all future complications. Keep in mind as you start on this path, every difficulty will be a chance of development and breakthrough. Do not lose concentration, remain flexible, so that all obstacles turn your FinTech application into a hardy and trustworthy instrument for the dynamic financial environment.

Cost of Building a Payment App: Unveiling the Financial Landscape

Cost Breakdown for Building a Payment App

| Development Phase | Cost Factors |

|---|---|

| 1. Planning & Research | Market research, competitor analysis |

| 2. Design & Prototyping | UI/UX design, wireframing, prototyping |

| 3. Backend Development | Server setup, database development, API integration |

| 4. Frontend Development | App interface, navigation, user experience |

| 5. Payment Gateway | Payment Gateway Integration with payment processors and gateways |

| 6. Security Implementation | Data encryption, secure authentication |

| 7. Testing & Quality Assurance | Functional testing, security testing, bug fixes |

| 8. Regulatory Compliance | Legal consultation, compliance with industry standards |

| 9. Deployment & Launch | App store fees, initial marketing |

| 10. Ongoing Maintenance | Updates, bug fixes, server maintenance |

Cost Factors by Phase

| Development Phase | Cost Range |

|---|---|

| Planning & Research | $5,000 - $15,000+ |

| Design & Prototyping | $10,000 - $30,000+ |

| Backend Development | $20,000 - $50,000+ (depending on complexity) |

| Frontend Development | $15,000 - $40,000+ (based on design complexity) |

| Payment Gateway | $5,000 - $20,000+ (varies with integration complexity) |

| Security Implementation | $10,000 - $25,000+ (emphasis on robust security) |

| Testing & Quality Assurance | $10,000 - $30,000+ |

| Regulatory Compliance | $5,000 - $20,000+ (legal consultations and compliance) |

| Deployment & Launch | $5,000 - $15,000+ (includes app store fees) |

| Ongoing Maintenance | Varies (usually 15-20% of the total development cost) |

Note: These cost ranges are just estimates that depend upon the app’s complexity, geographical location of development and its unique features.

The development of a payment app requires tremendous attention to detail and capital, distributed over many stages. Having such an idea about the costs involved allows one to plan appropriately for an effective budget, secure payments as well as the success of the application launch.

Conclusion: Embark on Your FinTech Adventure with Addevice

A deep dive into FinTech app development has taken us through the complexity of making new financial solutions by following the experience of Addevice, its Broxel and Sqoot projects.

Read also about the Cost to Create On Demand Marketplace.

We’ve untangled the complexities around FinTech app creation, AI’s role, addressing the hurdles, and dissecting payment app prices.

We warmly welcome you to discover the limitless possibilities in FinTech app development. You can imagine a revolutionary payment app or advanced investment platform and there are many opportunities in the FinTech space.

Are you ready for a FinTech adventure? Feel free to contact us today at Addevice for a free appraisal of your fintech vision. Let’s begin your FinTech journey now.

FinTech App Development, FinTech App Development How to create a banking app How to create a banking app

Building Your FinTech App

Delve into the world of financial technology with our expertise in crafting cutting-edge FinTech applications.

Explore our offerings:

✅ Dedicated FinTech development teams

✅ Tailored solutions for financial institutions

✅ Security-focused app development

Table of contents

FAQ

However, the timeframe to develop a fintech app depends on complexity, functionality, and compliance issues. It takes approximately 6 to 12 months for an end-to-end fintech app. Nevertheless, simple ideas might require less time.

The process of establishing a fintech startup comprises some important stages. Conduct market research, come up with a unique value proposition, obtain licenses and regulatory compliances, form an able team, and make business plans. Interact and work with legal, finance experts on how to approach the intricacies of the financial world.

The concept of a fintech app is based on modern technologies and digital provision of financial services. The app allows users to engage in different financial operations like banking, investing, and payment among others. The app goes behind the scenes by connecting to banks’ accounts, using security technologies such as AI towards improving its functions.

Fintech app architecture usually consists of the user interface for interaction, server for processing data input, database for safe storage of data and integration with external partners, for example, payment gateways or banking API. The architecture should ensure security measures among other crucial factors like compliance and can also be scalable.

TOP 8 trip planning apps 2024: Best trip organizers for you

TOP 8 trip planning apps 2024: Best trip organizers for you

How Much Does It Cost To Build An App For your business In 2024

How Much Does It Cost To Build An App For your business In 2024

![How to Create a Workout App: Detailed Guide [Business & Tech]](/storage/uploads/blog_post/thumbnail_photo/63f7286077982_How to Create a Workout App.png) How to Create a Workout App: Detailed Guide [Business & Tech]

How to Create a Workout App: Detailed Guide [Business & Tech]